Fritz Sybergs Vej 9

DK 8270 Hojbjerg

Scandinavia

info@dynamicbusinessplan.com

Understand the Assets

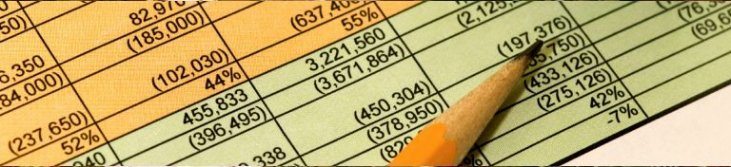

The Balance Statement shows the Assets and the Liabilities in the company. The focus is here on the Assets.

Example

Here is an example of a Balance Statement from a business, that are selling goods from a shop or are producing items in a factory.

|

Assets |

Liabilities |

||

|

Cash |

5.000 |

Creditors |

10.000 |

|

Bank account |

7.000 |

Loan from Bank |

11.000 |

|

Debtors |

3.000 |

Tax |

2.000 |

|

Stock |

11.000 |

Owners Equity |

19.000 |

|

Equipment |

4.000 |

. |

. |

|

Buildings |

12.000 |

. |

. |

|

Total |

42.000 |

Total |

42.000 |

Cash

The asset "Cash" tells the reader that you had 5.000 in "real

money" in somewhere in your company on this specific day.

5.000 is a lot of money to keep on the premises. But maybe you just received the

cash from a Debtor in the morning and have not had the possibility to put it

into the bank account. If possible always have your debtors to pay their debts

directly to the bank. It is safer.

Bank account

If you look at your bank statement it should in this instance show that 7.000 is placed on your bank account. This is money you can withdraw from the bank when you need it.

Debtors

Debtors are persons or businesses that owe your company money. The amount of money stated on "Debtors" represent the money you hopefully will see placed on your bank account within the next 30 days. When you sell on credit to a person this person becomes a debtor.

You should at least every month go through your Debtors file. The ones who

have not followed their payment obligation should be contacted at once.

There might be debtors who have been in this account for years. It might be an

idea to remove these debtors because they will never pay. You cannot consider

debtors who cannot pay an asset. It is a loss.

Stock

The figure stated in Stock is what you have found when you did your stocktaking. This means you counted all the items in the stock and figured out how much it worth.

You should evaluate the quality of your stock at least once a year. Are you still able to sell the specific item? Is it too old and obsolete?

If you continue to count stock which is worthless the asset called "Stock" will not represent the correct value.

Equipment

If your company has bought any big machines, cars or expensive office furniture the current value should be stated here.

Each year you depreciate (write-down) the value of the different pieces of equipment so it always represents the actual value on the specific day.

If during the years you have bought a new big machine you add the price of it

in the account.

If you have many different kinds of equipment it could be wise to make different

accounts. It will then be easier to overview these assets.

You could make these three account instead of just one: Equipment Production,

Equipment in Offices and Cars.

Each year you should review each piece of equipment and decide whether it is entered to the current market price or not. If not there might be a reason for not stating it at market price. it is important for you know why.

Buildings

If you have bought the building in which you run your company you state the

value of it here. If you live close the a major city the value may have risen

considerable during a year. The value of the building makes your company

financially solid. Remember to write up the value of your premises.

Go to next

business issue: Understanding the Liabilities

I’m convinced that about half of what separates the successful entrepreneurs from the non-successful ones is pure perseverance.

– Steve Jobs, Co-Founder of Apple