Fritz Sybergs Vej 9

DK 8270 Hojbjerg

Scandinavia

info@dynamicbusinessplan.com

Depreciation

Depreciation in relation to accountancy means; "Calculating the decreased value" of some of the Fixed assets.

The reason why the value of some of the Fixed Assets like tools and machinery decreases is that they get worn out by being used.

Example

When the production company "Kafue Company" in year 2005 bought their first Big Machine, the price was 20.000 $. It was used until the end of 2010 when a new one was bought.

When the old Big Machine was sold, they only got 1.000 for it because it was worn out. This means that the Big Machine had gradually lost 19.000 in value during the five years it was making items for the company.

Effect on the Financial Statement

To get a true picture of the value of Fixed Assets in a company it would therefore be necessary to calculate the depreciation every year and reflect it in the Financial Statement.

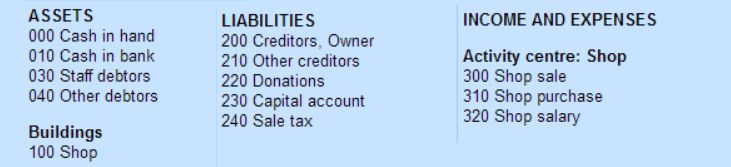

The depreciation will affect the value of Fixed Assets which is indicated in

the Balance Statement.

It will also affect the Profit and Loss Statement where the depreciation will

be deducted as an expense.

What to depreciate

If you decide that you have to decrease the value of some of the Fixed Assets in your company, it must be larger things which represent a considerable value and which lose value by being used and/or getting old. Smaller things like hand tools are not depreciated.

The depreciation must be calculated for each machine individually.

How to depreciate

First you have to decide for how long time you can expect the machine to work for the company before it will break down totally or you will want to replace it.

Secondly you must decide which price you can expect to get for it when you sell it.

Example

You estimate that your new Big Machine that have cost you 60.000 will probably work for five years and that you can eventually sell it at 5.000.

The easiest way to calculate the depreciation is to say that the machine loses the same value each year.

If you decide to use this way of calculating depreciation, the depreciation of the Big Machine which was bought at 60.000, will look like this:

The total amount which the Big Machine will lose in value is:

|

New price in 2014: |

60.000 |

|

- expected sales price in 2018 |

5.000 |

|

= loss of value during 5 years: |

55.000 |

Depreciation each year for 5 years: 55.000/5 years = 11.000

Effect on the Financial Statement

Each year you should deduct 11.000 from the Profit and Loss statement.

The value of the machine has to be registered on the Balance Statement in the coming years when you depreciate by 11.000 each year is:

|

2014: |

60.000 |

|

2015: |

49.000 |

|

2016: |

38.000 |

|

2017: |

27.000 |

|

2018: |

16.000 |

|

2019 |

5.000 |

There are other ways to depreciate. For instance by 30 % each year.

Contact your accountant to find the best way for your deprecations.

Double entry bookkeeping was a hell of an invention.

- Charlie Munger, investment manager and philanthropist.